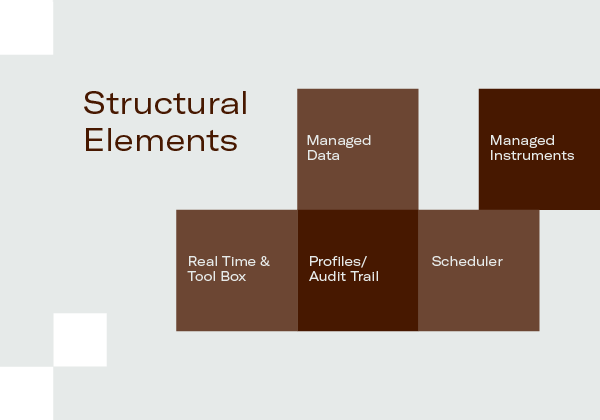

Manage a wide range of instruments

With SimCorp Sofia it is possible to manage a wide range of financial instruments, having promptly available all the information relating to the management and controlling processes of corporate finance.

The SimCorp Sofia database manages market data, allowing the archiving of information relating to prices, dealing volumes, FX rates, interest rates and market indices. Currently used in very complex operating realities, SimCorp Sofia allows the management of multi-portfolios, multi-companies and multi-currencies (in accordance with multi-GAAP).

For example, the execution of an order determines an automatic and immediate update in the portfolio holding and in the treasury situation. On one side, this approach guarantees for all users the prompt availability of the situation just updated while on the other it limits the need to resort to costly processing cycles.

- interrogation functions for visualizing portfolios or single holdings concerning any date interval, past or future, with the immediate recalculation of initial and final asset holding and financial and economic flows of the period

- screens that can be personalized and saved by each user

- selection, sorting, classification and sum functions immediately executable from each scrolling screen

- macro functions that allow to memorize sequences of user commands executed in a recurrent way and to recall these same commands when necessary

- an easy to use report generator with an output to text files, Excel files or printout

- data export functions in multi-format (Excel, Access, ASCII, SQL, etc.) for analysis and comparison with external systems’ data.

With SimCorp Sofia it is possible to manage all information supporting the process of management and control of investments.

Data Reference of the Financial Instruments

SimCorp Sofia allows the registration of the contractual elements of each financial instrument in a portfolio, including also the creation of all events (and cash flows), determined or determinable, until the expiry of the contract.This makes the following possible:

- a provisional analysis on P/L impacts and treasury

- the calculation of the theoretical price of the instrument based on market conditions and SimCorp Sofia® fair pricing models.

Complex financial instruments can be managed in a unitary way by means of opportune relations between the Data Reference of the elementary instruments of which they are composed. A wide number of fields, which can be easily customized by the user, allows the immediate grouping of the portfolio according to the desired classes.

Market Data

A database of market data allows the archiving, also automatically, of information relating to prices, dealing volumes, FX rates, interest rates and market indices. Such information can be used for:- the mark to market evaluation of portfolios with immediate evidence of the P/L impacts on each open holding according to the evaluation rules outlined

- the calculation of measures of yield and risk for entire portfolios or parts of them.

Thanks to its wide range of tools for the calculation of the fair price, SimCorp Sofia offers the possibility to evaluate ad hoc portfolios and financial instruments. This process of fair pricing holds particular importance for unlisted instruments.

Portfolios and Companies

Each portfolio can be replicated automatically in order to allow the subjects involved in the different phases of the investment process to carry out their diverse operative tasks. This replication also allows the application - to the same portfolio - of different evaluation and accounting rules.Transactions

Transactions in SimCorp Sofia can be created by the user, inserted using import functions or generated automatically by the program.For example, SimCorp Sofia develops the event plan of the security by automatically generating the transactions relating to future coupons and to the redemption of the instrument.

With SimCorp Sofia it is possible to manage a wide range of financial instruments and to support the organizational unit of the Customer involved in the processes of decision, evaluation, administration and control of investments.

Basic Instruments

SimCorp Sofia is able to manage all types of bonds, shares, Investment Funds, Money Market instruments, and FX spot and forward. In particular:money market instruments:

- repo

- fixed time deposit

- liquidity fund

- bonds at fixed or floating rate

- bullet, sinking and zero coupon

- with embedded options (callable, puttable)

- structured

Investment funds and ETF's

Derivative Instruments

With SimCorp Sofia it is possible to manage also derivative financial instruments, both OTC and listed, such as:- OTC and listed options on equities, bonds, FX rates, rates and indices

- futures and OTC forward contracts on equities, bonds and indices

- rate swaps, also on cross currency and equity swaps

- currency forwards and NDF

- credit default swap

- securities lending and collateral management

Cash

With SimCorp Sofia it is possible to manage the liquidity position of portfolios by calculating the monetary impact of each transaction on balances of investment current accounts at any past, present or future date.Collateral

With SimCorp Sofia the representation of given and/or received collateral holdings is possible with respect to:- securities lending (OSLA contract)

- OTC derivatives (ISDA contracts)

- listed derivatives (initial margins)

- the workstations from which they can access SimCorp Sofia

- the access levels to the information, which can even be set at a single portfolio level and at a single asset class level

- information that they can add or modify

- the sets of reports, macros and classifications that they can visualize.

To each profile is also associated a set of preferences that enables the single user to memorize the visualization screens of the data and the evaluation rules of the holdings. Concerning the audit trail, SimCorp Sofia allows the reconstruction of all the tasks completed by the user on all the main archives (orders, transactions, data reference, etc.)

The scheduler is a tool purposefully developed to allow the automatic execution of macros with a desired frequency at predefined times, eliminating the need of user involvement.